SHARIAH INVESTING

SHARIAH INVESTING

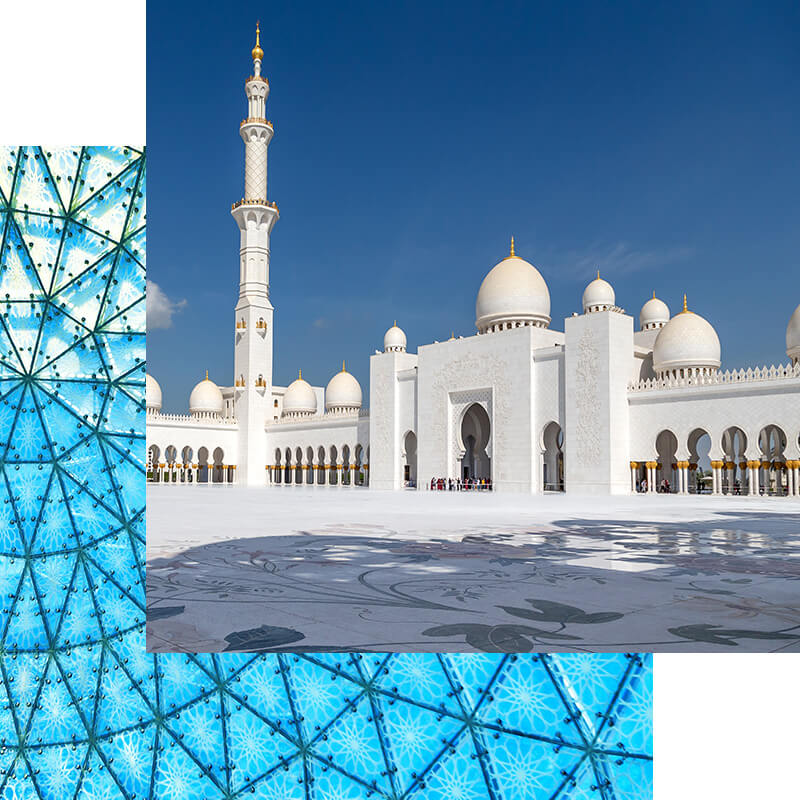

Global demand for Shariah-compliant investments remains strong. Since receiving our Islamic fund management licence in Malaysia back in 2009, we have successfully built an investment platform guided by Koranic principles.

With a network of some 50 offices around the world, we have an on-the-ground presence in the key centres of Shariah finance located in the Middle East and Southeast Asia. This means we can leverage our deep understanding of local markets, while drawing on the group’s global resources, to serve clients better.

We strive to deliver robust returns through the active management of assets against benchmarks, focusing on Shariah-compliant equities, sukuk and property. Investments are made using the same rigorous processes that determine investments in our non-Shariah portfolios. In addition, we work with independent religious scholars to ensure that Islamic principles are strictly followed.

OUR CORE CAPABILITIES ARE:

Shariah-compliant Equities

Our expertise is in stock picking. Company due diligence and original research are at the core of everything we do. We believe that our success lies in a consistent approach, irrespective of market conditions. We never chase fads and invest for the long term. Equity fund managers are based around the world.

Sukuk Bonds (Islamic bonds)

Our team in Rotterdam provides research for the onshore local currency market, but we also draw upon our global resources to invest in offshore dollar-denominated sukuk debt. Fund managers around the world help with credit analysis, portfolio modelling and risk management.

Private Equity Investments (Musaraka)

Our team in Rotterdam provides research for the onshore local currency market, but we also draw upon our global resources to invest in offshore dollar-denominated sukuk debt. Fund managers around the world help with credit analysis, portfolio modelling and risk management.

OUR TEAM IS READY FOR YOU

Global demand for Shariah-compliant investments remains strong. Since receiving our Islamic fund management licence in Malaysia back in 2009, we have successfully built an investment platform guided by Koranic principles.

With a network of some 50 offices around the world, we have an on-the-ground presence in the key centres of Shariah finance located in the Middle East and Southeast Asia. This means we can leverage our deep understanding of local markets, while drawing on the group’s global resources, to serve clients better.

We strive to deliver robust returns through the active management of assets against benchmarks, focusing on Shariah-compliant equities, sukuk and property. Investments are made using the same rigorous processes that determine investments in our non-Shariah portfolios. In addition, we work with independent religious scholars to ensure that Islamic principles are strictly followed.

RISK MANAGEMENT FRAMEWORK

The Risk Management Framework articulates the objectives, guiding principles, governance structure and processes inherent in the way risk management will be carried out in Almoravid.

The risk management processes consist of the activities of risk identification, assessment, measurement, control and monitoring. As such, all methodologies, structures, procedures, policies and systems will contribute to one or more of these activities. This will be evident in the detailed frameworks dealing with the management of credit, market and operational risk.

The risk function for Almoravid is governed by the Board of Directors. The day to day management of risk at Almoravid is carried out by the Risk Management Unit of its parent company.