ESG INVESTING

ESG INVESTING

With growing awareness on the potentials of the Islamic finance, it has spurred the growth in demand for Shariah-based investment solutions. The industry is no longer regarded as a mere “alternative” to the conventional financial system, but a mainstream with its own facets. One major growth area is the asset management arena. Demand for Shariah compliant investment products stretched from the local to regional markets right up to the Middle East and beyond the boundaries of Asia.

Hence, almoravid exceptional and distinctive background allows for the offering of a unique blend of Asian equity and global Sukuk investment products and services. This adds to our ability to address the increasing demand for sophisticated Shariah investment solutions through true product differentiation.

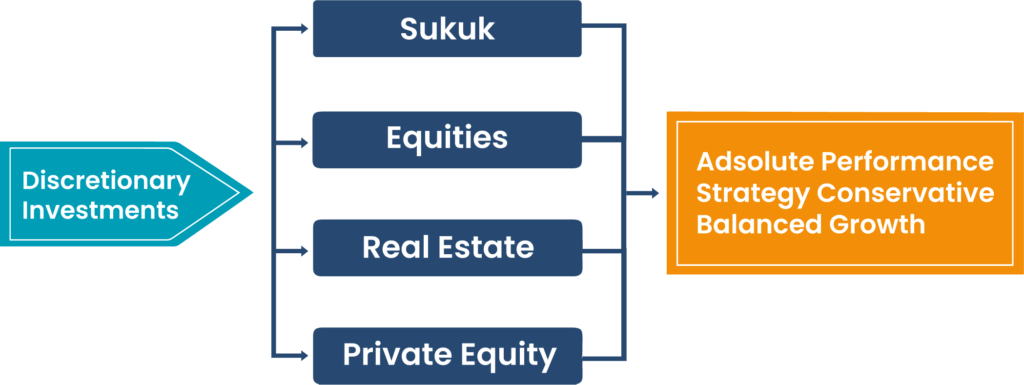

At Almoravid, we understand that different investors have differing financial needs which call for customised investment solutions. In order to assist investors to achieve their investment objectives, we offer these investment services covering different types of asset:

Global insight, local view

With 120+* equity professionals on the ground around the world, we combine deep local insight with a global perspective. This unique insight helps us to make more holistic investment decisions – and create strategies to meet a wide range of investor goals. *As at 30 June 2021

ESG engagement

Actively engaging with companies to improve environmental, social and governance (ESG) standards is integral to our equity process and ethos. By encouraging positive change, we aim to improve outcomes both for investors and the wider world.

Diverse outcomes

We carry out our own thorough, team-based research to help us find good quality opportunities. Our aim is to meet the needs of investors. Whatever their priorities – from income and growth to sustainable investing – our experience and global equity resource allow us to target a wide range of outcomes.

OUR ESG APPROACH TO EQUITY INVESTING

We believe that ESG factors are financially material and can impact a company’s performance – either positively or negatively. Understanding ESG risks and opportunities, alongside other financial metrics, is therefore an intrinsic part of our research process.

We actively engage with the companies in which we invest. We combine information from these meetings with the insights of our investment managers, ESG equity analysts and central ESG investment team. This comprehensive approach means we can build a richer, more holistic view of each company. It also means we can consistently evaluate one company against another.

This approach is all part of our responsible stewardship of our clients’ assets – helping us mitigate risks, unlock opportunities and enhance long-term returns.